Sustainability Reporting in the Housing Industry

A meta-analysis of the sustainability reports published by the top 50 housing companies in Germany

CSR, sustainability, ESG—sustainability is the most important megatrend of our times, which also makes it the top subject on the agenda for the real estate industry. Since this is such a complex, dynamic subject, a number of approaches, standards, and parallel developments have emerged. RITTERWALD set out to determine how the real estate sector views the different sustainability-related topics. Which do companies think are most important? Which are less important? And is there a sign of industry standards emerging? To this end, RITTERWALD took a closer look at the sustainability reports published by the top 50 companies in the German housing sector.

Overall legal conditions and standards

All of the leading reporting standards for sustainability are published by nonprofit organizations. Across the board, there is a trend toward consolidation1 and an increased focus on the Sustainable Development Goals (SDGs).2 At the same time, the EU is working on the introduction of the EU taxonomy3, a classification system for economic activities that are sustainable both environmentally and, in the long term, also socially. The EU taxonomy is an important step in expanding sustainable investments. It is expected to further spur the sustainable finance market, which is currently seeing robust growth.

Legislative reforms directing sustainability are also on the rise at the national level. One of the most important sustainability laws passed so far is the CSR Directive Implementation Act. This law, which took effect in 2018, requires companies and corporate groups that are oriented toward the capital market4 and have more than 500 employees on average across the year to explain all aspects of their sustainability performance and targets that go beyond their actual financial key performance indicators.5 Another very recent development is the 2021 Climate Change Act,6 which was passed by the German federal government in the wake of a decision by the Federal Constitutional Court in May 2021. The new law has brought the target date for climate neutrality forward by five years, to 2045. In that judgment, the country’s highest constitutional court concluded that the existing climate action targets were incompatible with the fundamental rights of younger generations.

These changes in the overall conditions will also affect the German housing industry as a matter of course. One expression of this is the German housing sector’s “Wohnen 2050” (Housing 2050) initiative,7 which is intended as an industry voice and platform for sharing knowledge on the topic of sustainability. The housing industry’s increased commitment and interest in subjects relating to sustainability is important and necessary. Studies have shown that approximately one-third of all CO2 emissions in Germany come from buildings.8

RITTERWALD views the new focus within the industry as one reason to take a closer look at the sustainability reports published by the top 50 companies9 in the German housing sector. Our goal is to find out which sustainability topics are most important to the German housing industry. Our analysis follows the sustainability definitions used by the Global Reporting Initiative (GRI) and the German Sustainability Code (GSC), both of which define sustainability as the interaction of three key elements: economics, the environment, and social responsibility. How have these elements been reflected in the organisation and strategy of the German housing companies so far? What changes has sustainability already brought in the housing sector? What topics does the industry identify as material? Our analysis of the reports highlights the growing importance of these topics—and the initial difficulties they present.

A closer look at materiality analyses

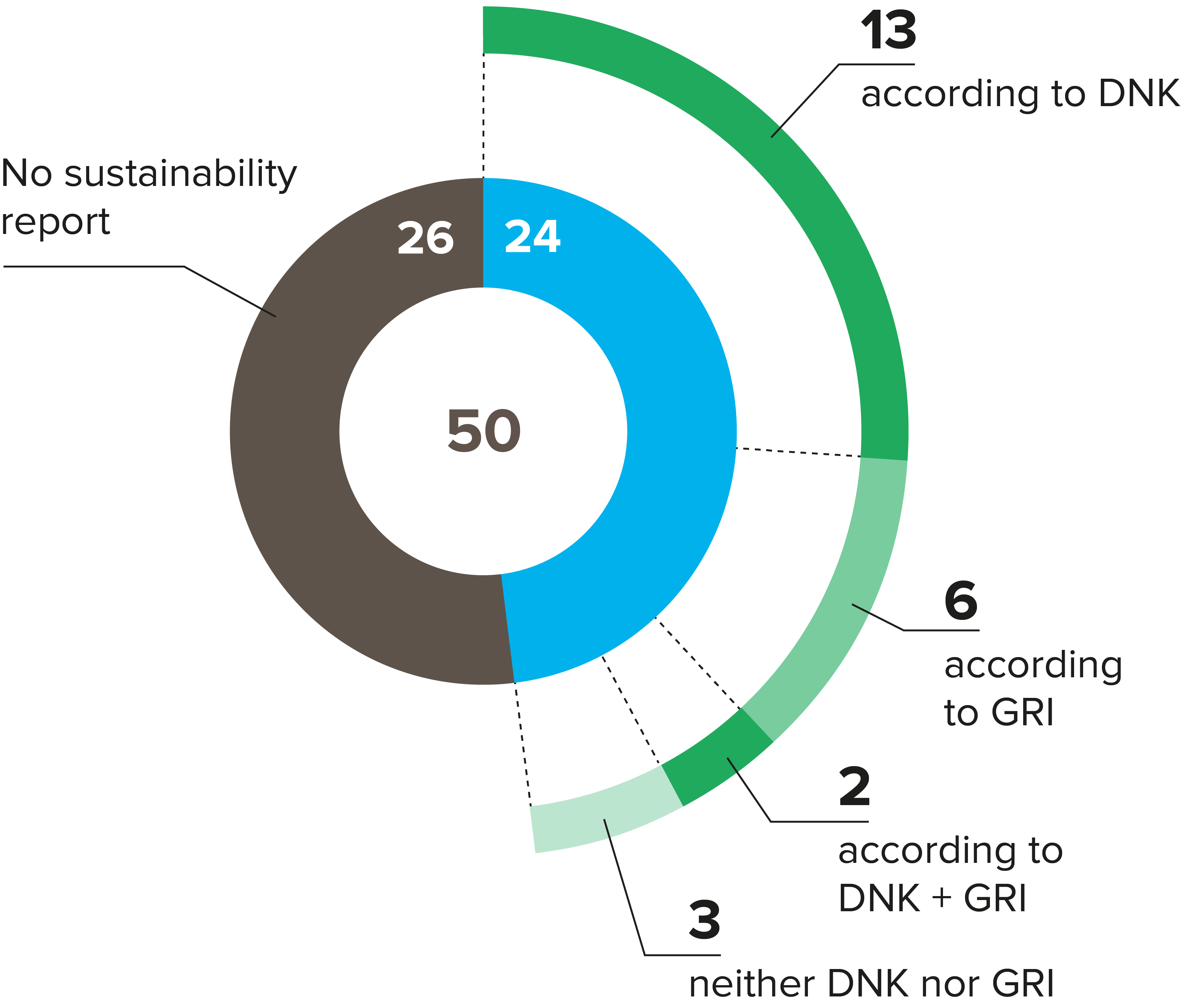

The first sustainability reports in the housing industry were published back in 2010 by Gewoba Bremen and Munich-based Gewofag. Today, some 11 years on, more than half of the top 50 companies have taken a position on the topic of sustainability, mentioning it on their websites or in reports. Although only 11 of the top 50 companies are legally obligated to report on sustainability, 24 of them have already published at least one sustainability report in the past five years (see Fig. 1).

Fig. 1: Sustainability reports of the top 50 German housing companies

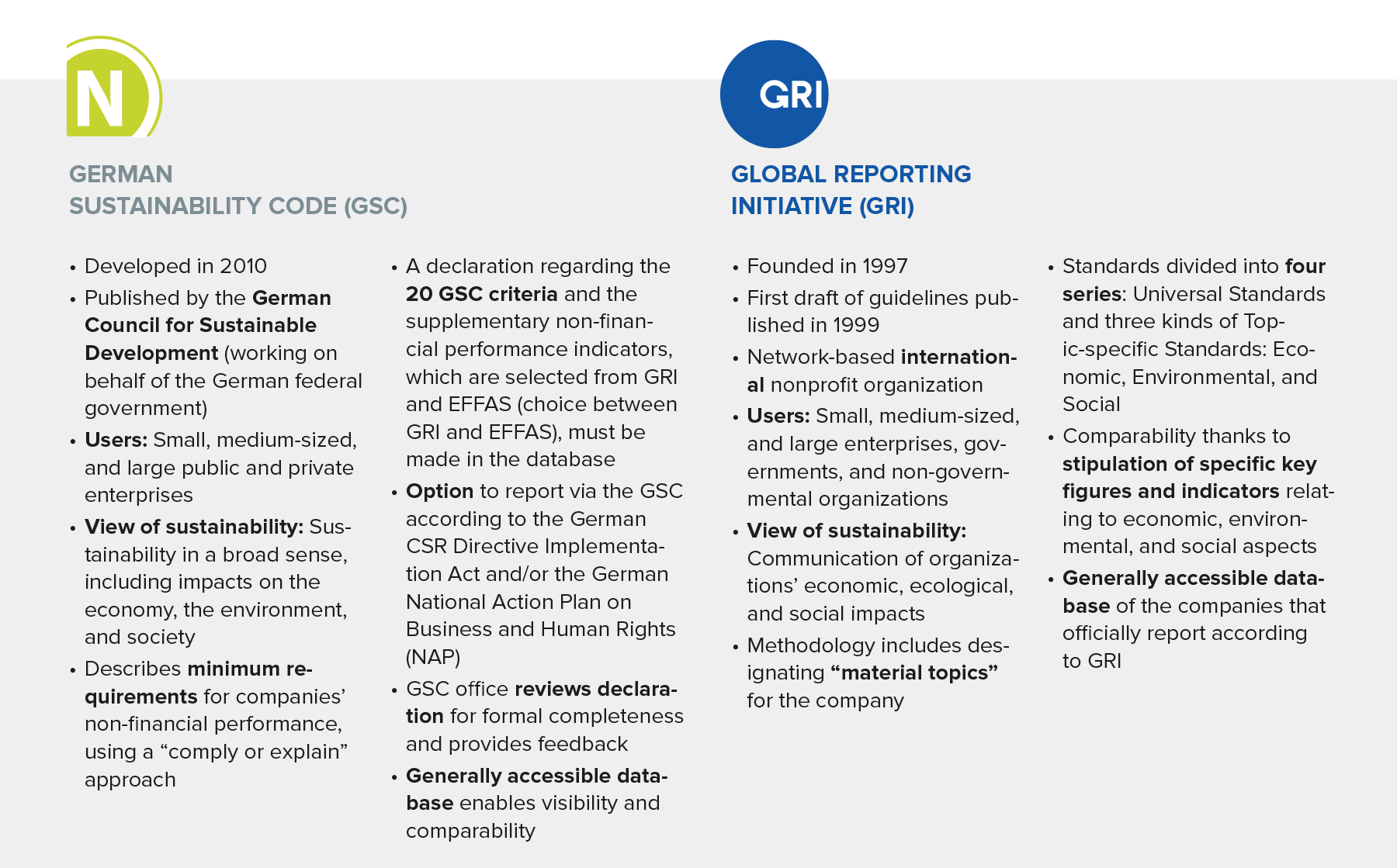

Thirteen of these companies report according to the German Sustainability Code (GSC), six according to the leading international standards published by the Global Reporting Initiative (GRI), and two according to both. In addition to the reporting according to the GSC and GRI (see Fig. 2), some private housing companies report according to the reporting standards of the European Public Real Estate Association (EPRA sBPR). There are also individual cases in which sustainability reporting is based on standards other than those mentioned above.

Fig. 2: The two leading sustainability standards in Germany in brief

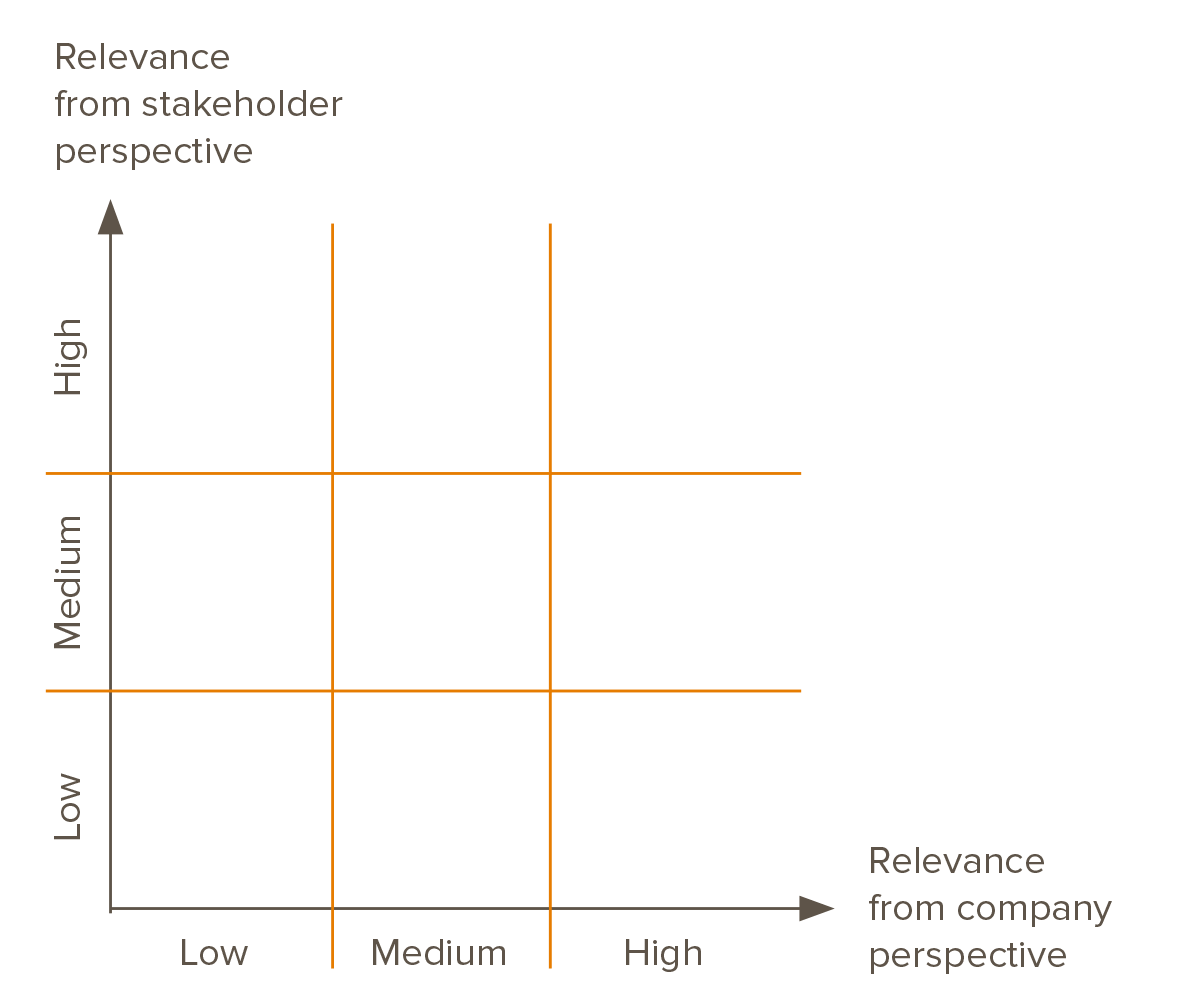

These sustainability reports vary greatly, despite their reliance on the two leading standards, GSC and GRI. With no specific legal stipulations in place, they differ in content, scope, level of detail, and methodology. Since the inconsistency among reporting standards makes qualitative comparison more difficult, our analysis focuses on the materiality analyses performed by the companies. As these typically take the form of materiality matrices (see Fig. 3), we use this term for the visualization of results.

Fig. 3: Sample view of a materiality matrix

A materiality matrix is an analytical tool used to identify, prioritise, and present topics that are most important to the company and the environment it is operating in. However, an industry-wide standard in this regard has yet to be developed, and the matrices identified diverge in terms of scale, structure, and level of detail. Still, they offer a valid starting point for an industry comparison. Detailed analysis of the materiality analyses is also highly relevant in light of existing legislation. The law provides that reporting must be geared toward the principle of materiality and take internal and external factors into account in determining a particular topic’s materiality.10

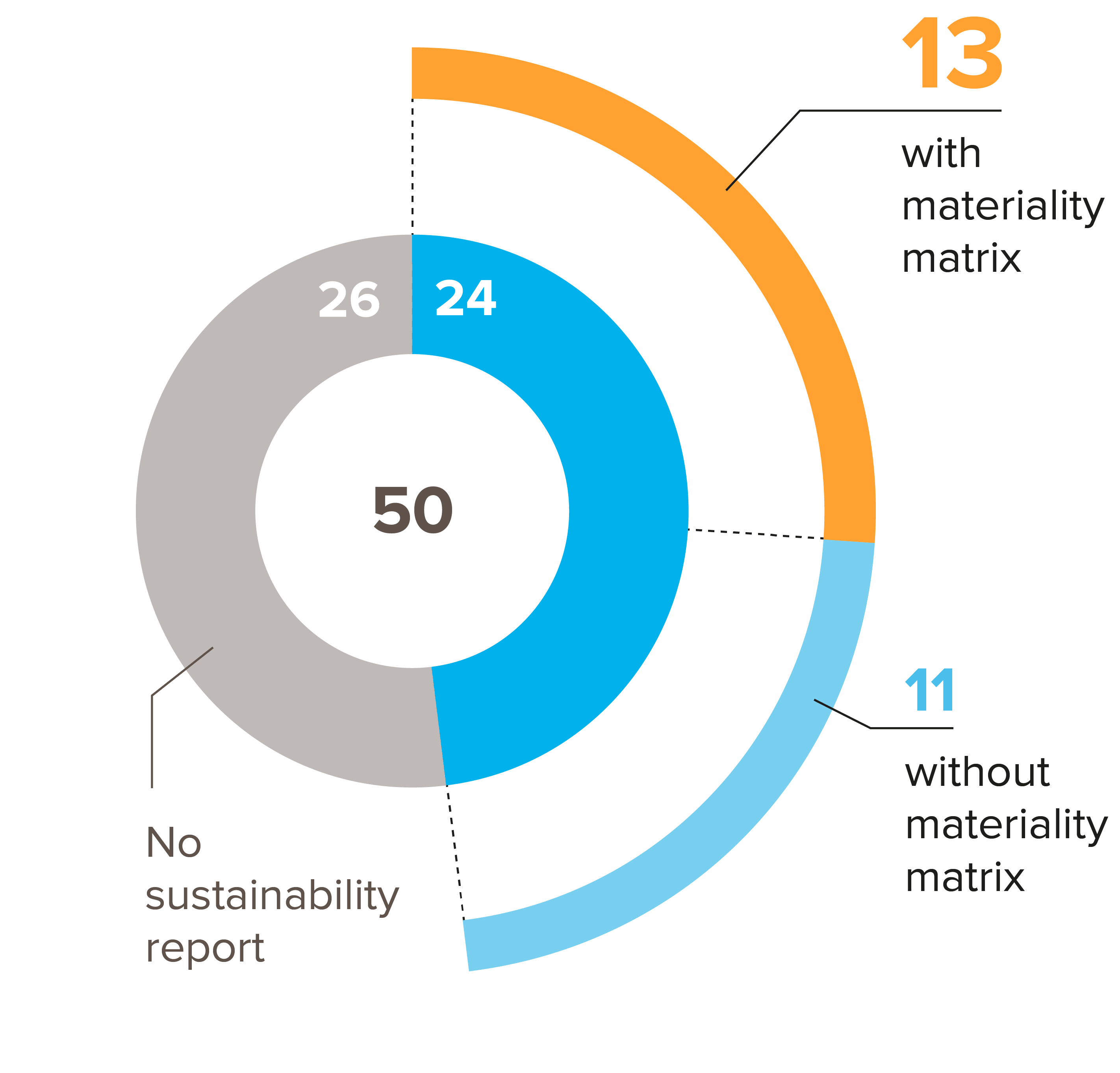

More than one-quarter of the housing companies have already performed a materiality analysis, and published this information in their sustainability reports (see Fig. 4).

Fig. 4: Number of companies that have published reports containing a materiality matrix

Since these analyses are not performed annually, the materiality matrices considered in this study are not all equally current. There are also differences in terms of level of detail. Of the 13 companies considered that have performed and published a materiality analysis, seven are private11 and six are municipal entities12.

Approach and identification of topics

Our analysis of the materiality matrices shows a broad spectrum of topics. The 13 matrices identify a total of 321 topics as material. The average number of topics mentioned was 25 (minimum 12, maximum 39). The topics were clustered together to identify 44 fields of action highlighted by at least two companies through their materiality matrices. We then assigned these 44 action fields to the three pillars of sustainability—the environment, economics, and social matters13—based on the leading reporting standards.

Analising the standardised materiality matrices in this way14 makes it possible to identify the top subjects in the three sustainability segments by averaging the two dimensions (company/stakeholder). Establishing this kind of average allows for a direct comparison of priorities for the individual identified topics per segment. The third dimension (number of companies that identify the specific topic) is added to identify the top subjects.

The goal of our meta-analysis is to identify the material sustainability topics in the industry and establish a materiality matrix for the German housing sector. This matrix (see Appendix, p. 10, Fig. 8–11) was created to present the first-ever comprehensive view of sustainability topics in the housing industry, situate them according to priority, and highlight the granularity and lack of standardisation within the German housing sector in the area of sustainability topics. It can be used as a starting point for further materiality analyses or for benchmarking, among other possibilities.

Results of the analysis—

What are the key topics for the German housing industry?

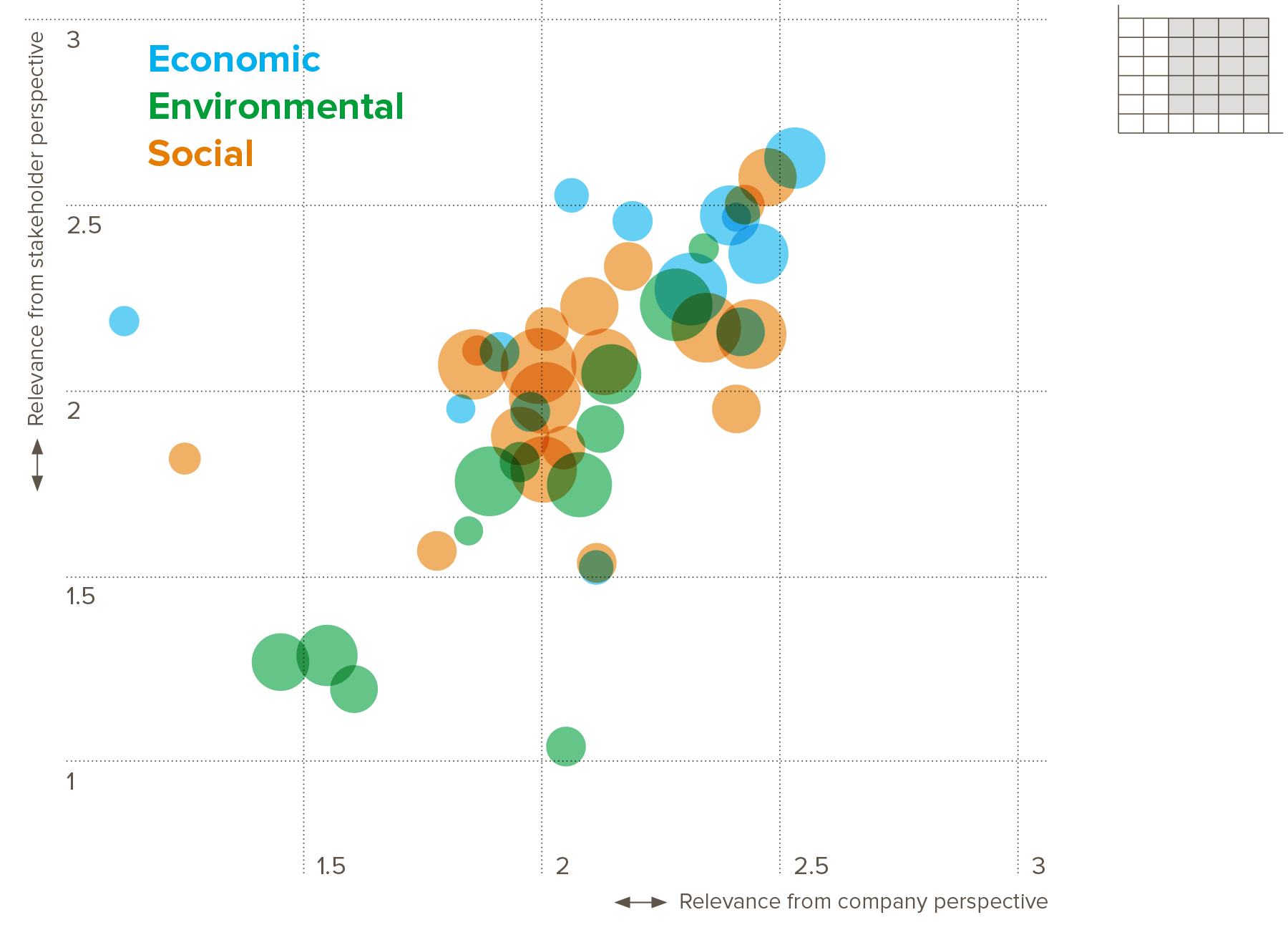

A direct comparison of ecological, economic, and social topics shows that economics is the highest-rated sustainability dimension in terms of materiality, with an average relevancy rating of 2.24 on a scale from 0 to 3. Next on the list are social matters, at 2.08, followed by the environment, at 1.81.

An analysis of the top subjects highlights the current challenges facing the German housing sector: growth in existing housing stock, climate action, emissions, energy, and affordable housing. It also gives us insight into important areas of tension within the industry. How can climate targets be met while simultaneously growing the existing housing stock at the lowest possible cost? And can this new housing specifically be used to ensure socially responsible, affordable rents?

Conflicts of goals between the sustainability pillars of economics, the environment, and social responsibility are possible. For more nuanced findings, the next section considers the material topics in these sustainability areas in detail.

Key economic topics

The top three topics in the area of economics are development and stock acquisition, financial performance, and good governance.

The top subjects thus highlight the challenge posed by the growing need for housing, which is specific to the housing industry. Even with the ramp-up in new construction since 2009, new housing construction lags behind demand15, as clearly illustrated by the growing construction backlog.16 The strong growth in existing housing stock, whether through new construction or purchasing, is associated with significant financing needs. Ensuring low-cost financing and the greatest possible cost efficiency in growing the existing housing stock are key elements of sustainability in the activities of housing companies. The subject of compliance and fighting corruption is the only one of the 44 topics that all companies consider to be material. This is attributable to several factors specific to the housing sector: numerous procurement avenues in the repair and maintenance segment, stringent regulations on rental and management (particularly including liability), and the complexity of real estate transactions. While these aspects are assigned to their own dimension of sustainability (governance) under the ESG ratings, the reporting standards frequently fold them in with the economic dimension as an aspect of responsible corporate governance. It is striking that only three companies associate the opportunities that come with the increasing digitisation of processes and buildings with the topic of sustainability, even though digitisation offers significant potential for increasing economic performance capability and encourages effective compliance management through greater data transparency.

Fig. 5: Number of companies that have highlighted this topic area in materiality matrices and specific assessment in each case

Key environmental topics

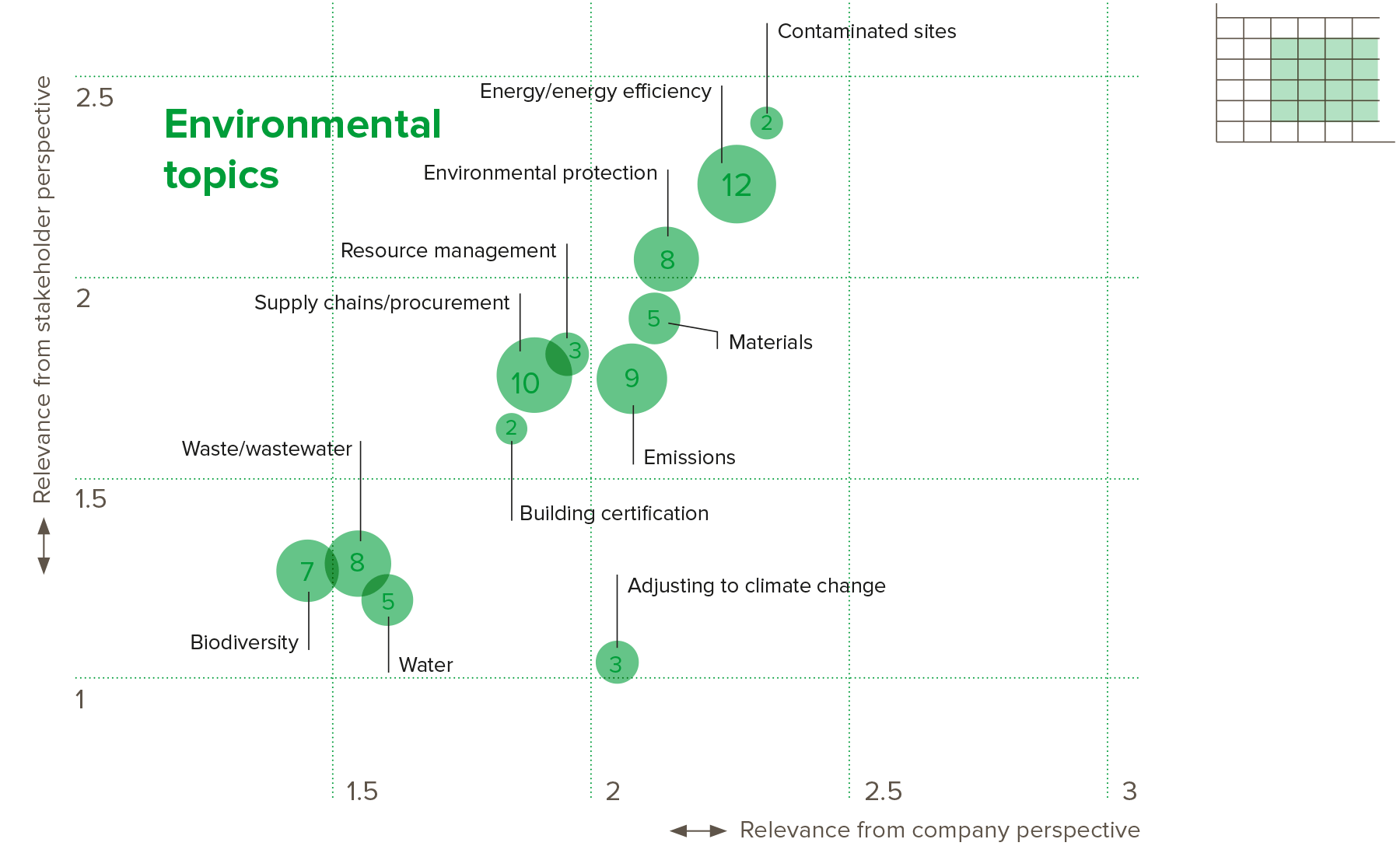

Energy is the central theme when it comes to the environment. Most of the companies viewed this topic as material, and it was ranked second highest in terms of priority. Expansion of renewable energy facilities and enhancing energy efficiency in companies’ own existing housing stock are the top priorities here. Alongside energy, housing companies also view protecting the environment and emissions as especially important top subjects. This is another area where the issue of a lack of industry standards comes to the fore, however, as different housing companies place the same environmental aspects differently within these three heavily overlapping thematic areas. All of the top three topics contribute to what is arguably the most crucial sustainability factor in the German housing industry: the energy efficiency of existing buildings. In 2017, the building sector was responsible for about 35% of energy consumption in Germany.17 This means the housing sector has a lot of leverage and an important role to play when it comes to achieving the EU’s goal of climate neutrality across the European Economic Area by 2050. Green electricity and the modernisation of both buildings and heating systems are just some of the many avenues the industry can explore to reduce energy consumption and emissions and come closer to meeting CO2 targets. Many housing companies have already addressed the top subjects of energy and emissions over the past few years through modernisation programmes and implemented the most cost-effective measures (quick wins such as replacing windows, heating systems, and electric boilers), which have allowed for significant reductions in emissions in many cases. The next step, further gains in energy efficiency, will carry a hefty price tag, leading to the same type of conflict of goals mentioned above with regard to companies’ economic objectives.

The topics of climate action, preventing and reducing pollution, and biodiversity are already being addressed by many housing companies. The EU Taxonomy is however more prescriptive with requirements regarding “adjusting to climate change”, shifting to a “circular economy”, “sustainable use and protection of water and marine resources”. Only few housing companies adressing these topics — an indication that the EU taxonomy has not yet been adequately taken into account in these materiality analyses.18 With the taxonomy taking effect in 2021, future materiality matrices published by housing companies are sure to feature these environmental criteria included in the taxonomy more prominently.

Fig. 6:

Number of companies that have highlighted this topic area in materiality matrices and specific assessment in each case

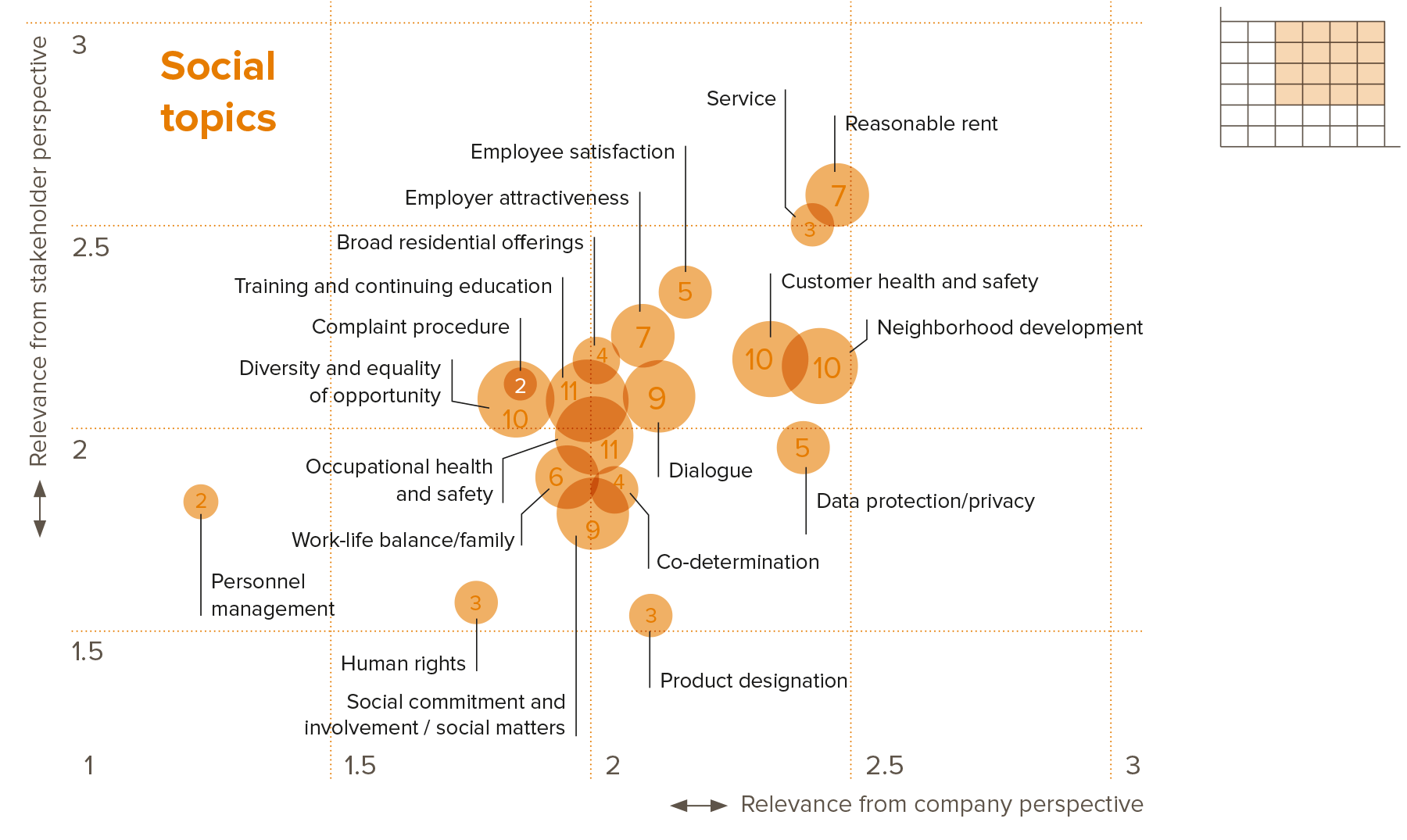

Key social topics

With 19 fields of action, the area of social responsibility is subdivided most broadly by the housing companies, which view it as relating to customers, employees, and society as a whole. This reflects the German housing industry’s self-image and development background from its basis in the state and municipal context with a focus on social provision of housing for broad segments of the population. When the top topics are considered, it becomes apparent that sustainable living and climate action must be socially compatible for the housing industry: Sustainable neighborhood development, customer health and safety, and training and continuing education are predominant in the companies’ ratings and in terms of the number of reporting companies. Within the framework of social responsibility, human needs must take center stage. This area is the most difficult to pin down or gauge, and establishing key indicators by measuring and reporting on achievement of targets in these topic areas is very challenging. What metrics are there for measuring things like the goal of developing livable neighborhoods, for example? However, ensuring the ability to measure these kinds of social goals is crucial. The development of livable neighborhoods could be eclipsed by the goal of low-cost, energy-efficient new construction with affordable rents if the value of livable neighborhoods cannot be measured in greater detail, for example. Our analysis shows that affordable rents are of the greatest importance, but are mentioned less often than the neighborhood development aspect. Measuring the key topic of broad residential offerings is also difficult—even though the current discussion surrounding the housing market highlights the great importance of this subject.

Fig. 7: Number of companies that have highlighted this topic area in materiality matrices and specific assessment in each case

Municipal vs. private

If the materiality matrices are analised according to owner structures, there are no significant differences between private and municipal companies on most topics. There are only a few cases of interesting divergences. For example, it is noteworthy that private companies identify both adjusting to climate change and resource management as material. This assessment may be associated with the upcoming adoption of the EU taxonomy and seems to be an indicator of the direction in which things are going. Municipal companies, which are not oriented toward the capital market and hence will not be bound by the obligations involved in the EU taxonomy in the short term, have not reported on these topics thus far.

Legal reasons are also likely responsible for the fact that all of the private companies studied, but only three municipal housing companies, view the aspect of procurement as a high priority. Publicly listed companies are obligated to ensure closer scrutiny of sanctions lists in order to accommodate the requirements and interests of institutional investors (foreign ones) at all times. This has various impacts, including the fact that publicly listed companies may need to consider not only the EU sanctions lists, but also the US ones. The new supply chain law passed in March 2021 to strengthen human rights is another current example of the increasingly stringent requirements that apply to the major19 housing companies in this area. The new law has brought significant requirements.20

On the other hand, the topics of digitisation and contaminated sites (particluar issue in Germany due to asbestos) were only included in the materiality matrices of municipal companies. In particular, the low importance attached to digitisation seems surprising given the investments the housing companies are making in regard to digitisation. Contrary to our expectations, the topic of complaint management was also not very prominent in direct terms, even though numerous client projects at RITTERWALD focusing on management in recent years were directly related to the topic of complaint management and customer satisfaction.

Analysis

The broad-based market study performed by RITTERWALD showcases the differences in focus among the top 50 companies in the housing industry when it comes to the topic of sustainability. It is clear that discrepancies in reporting standards remain a challenge for the industry. Without proper standardisation of the reporting standards itself, the content of the housing companies’ sustainability reports is heterogeneous as well, making transparent communication more difficult—for the reports’ audiences and authors alike. For example, only about 54% of all reports include a materiality analysis. Despite these differences, our analysis of the sustainability reports showed that for all three of the main factors in sustainability (economics, environment, social matters), there are fundamental trend topics that apply across the entire housing industry.

In the area of economics, this means growing the existing housing stock while also ensuring financial performance and fair management in the sense of compliance with applicable standards and actively fighting corruption.

As the focus in the environmental segment is on the topics of energy, emissions, and environmental protection, it largely centers on the sustainable achievement of climate targets. The third pillar, social aspects, focuses on reasonable rents, customer health and safety, and sustainable neighborhood development.

The conflicts of goals among the top topics make it clear how difficult it is to balance the three pillars of sustainability. This will pose long-term challenges for the German housing sector. We expect the impact of the coronavirus pandemic to shift the ways that social topics are assessed in the next few years. One change is likely to come in the area of customer and employee health, for example.

Our detailed analyses show differences between private and municipal housing companies. Only the materiality analyses of individual private housing companies already tie in with the EU taxonomy. We were surprised by how infrequently digitisation was identified as a sustainability topic by both private and municipal companies.

Outlook

Our meta-analysis represents an initial rough analysis of sustainability in the German housing industry and offers many different approaches for further detailed analysis. For example, the analysis of the sustainability reports published by Germany’s top 50 housing companies shows that sustainability is quickly rising up the agenda, and not just in a social context. More and more companies—including in the German housing industry—are actively grappling with their responsibilities, their impact, and the options open to them for greater sustainability in their actions. The increasing publication and voluntary review of sustainability reports by auditors is an expression of this enhanced focus. But reporting alone is not enough, of course. It is hugely important to view identified topics in the context of strategic and operational actions.

RITTERWALD believes that extensive research and study of this data is an outstanding starting point for the deeper analysis of individual fields and development of sector-specific key indicators relating to specific topics. This will allow us to identify important shifts early on in the future and to highlight them in time series analyses.

We can use our meta-study to identify the places where housing companies deviate from the market. RITTERWALD provides support with market standards for preparing company-specific materiality analyses. However, our focus is first and foremost on embedding our findings into a holistic sustainability strategy that contributes toward the specific company’s strategic and operational alignment.

This analysis can also serve as a point of departure for industry-wide discussion in order to develop an industry standard—like the working group that developed the Sustainability Reporting Standard for Social Housing for the British market in 2020. RITTERWALD provided this working group with the social and environmental criteria for our pan-European Certified Sustainable Housing Label at the start of 2020, which was used as a starting point for discussion of the relevant criteria. The Sustainability Reporting Standard for Social Housing is the product of coordinated effort of different stakeholders within the British social housing industry to establish its own ESG reporting standards. The new standards will harmonise and thus simplify the sharing of information with banks, investors, and other stakeholders.

Appendix

Key sustainability topics

in the German housing sector

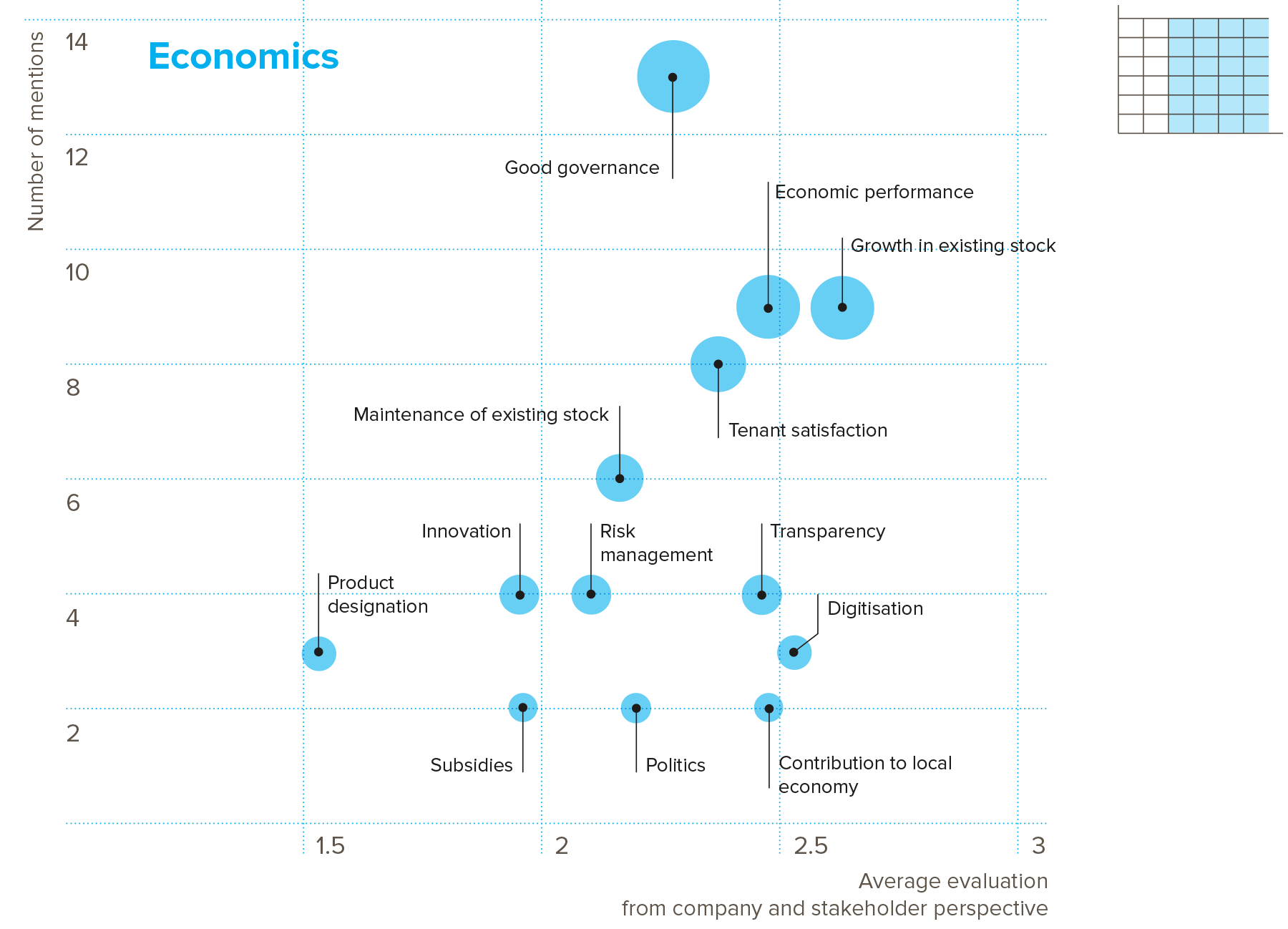

Fig. 8: Assessment of the relevance of topics in the area of economics from the company and stakeholder perspective Figures in circles indicate how many companies use each term in their reports

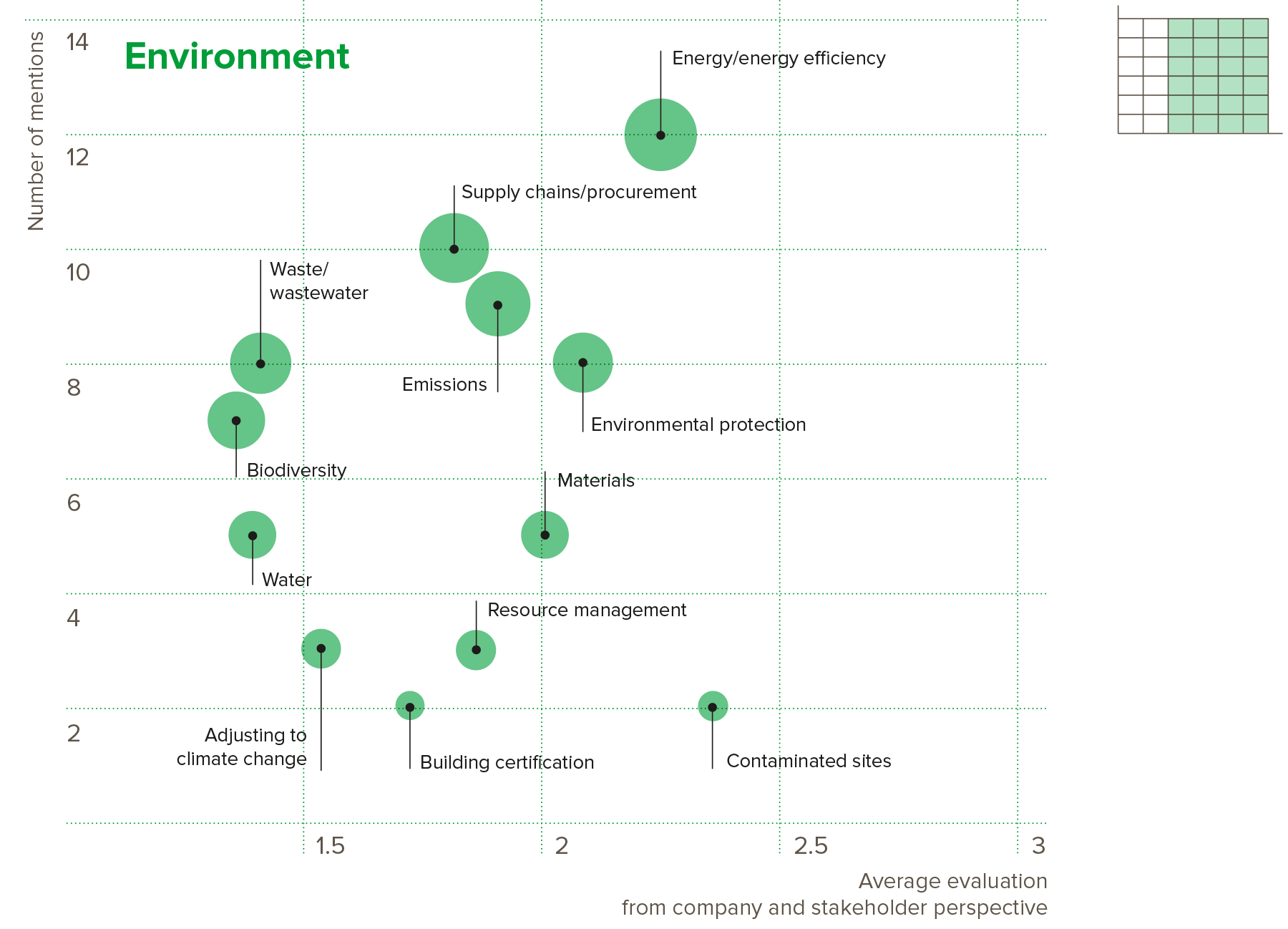

Fig. 9: Assessment of the relevance of topics in the area of the environment from the company and stakeholder perspective Figures in circles indicate how many companies use each term in their reports

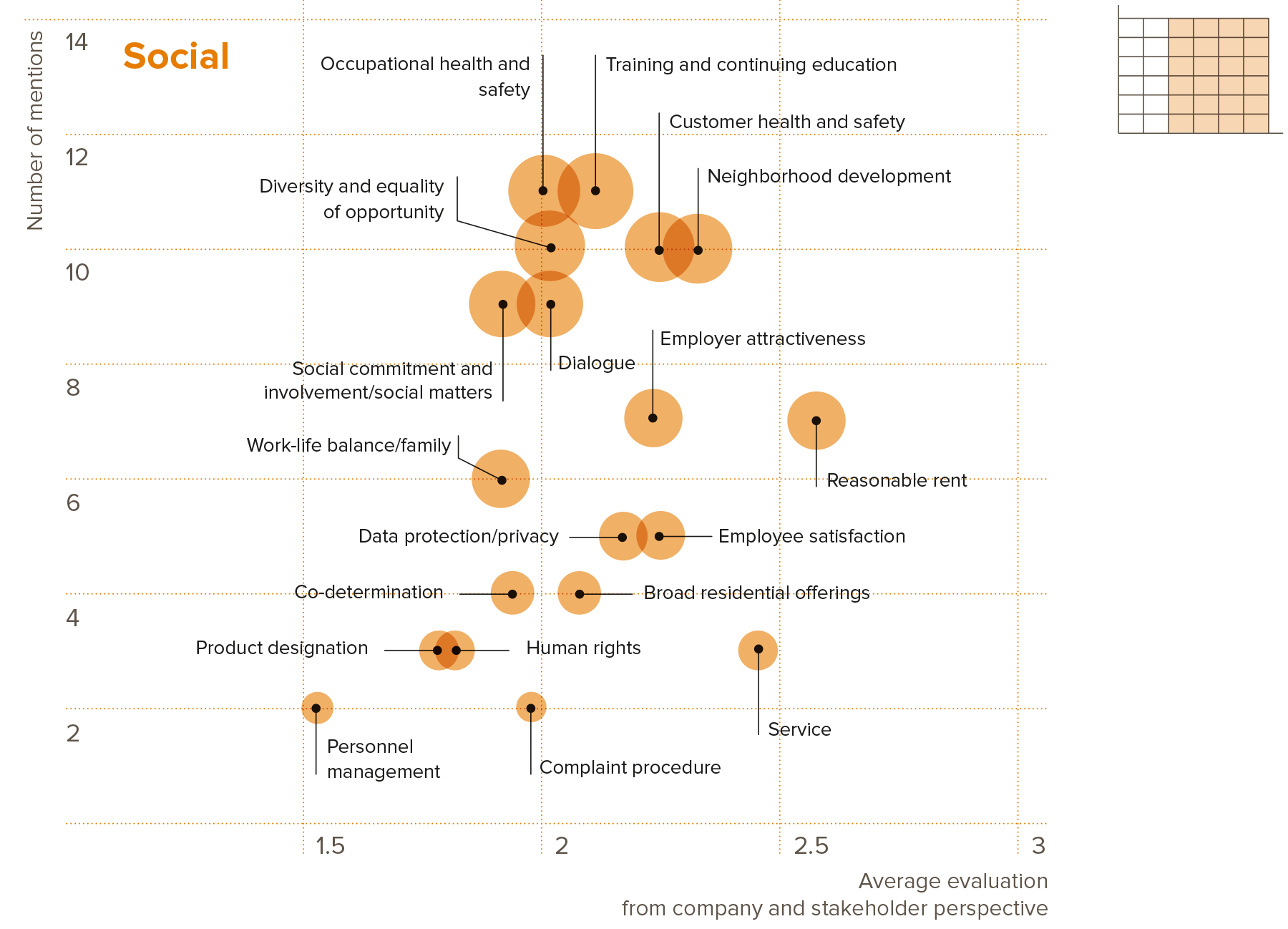

Fig. 10: Assessment of the relevance of topics in the area of social matters from the company and stakeholder perspective Figures in circles indicate how many companies use each term in their reports

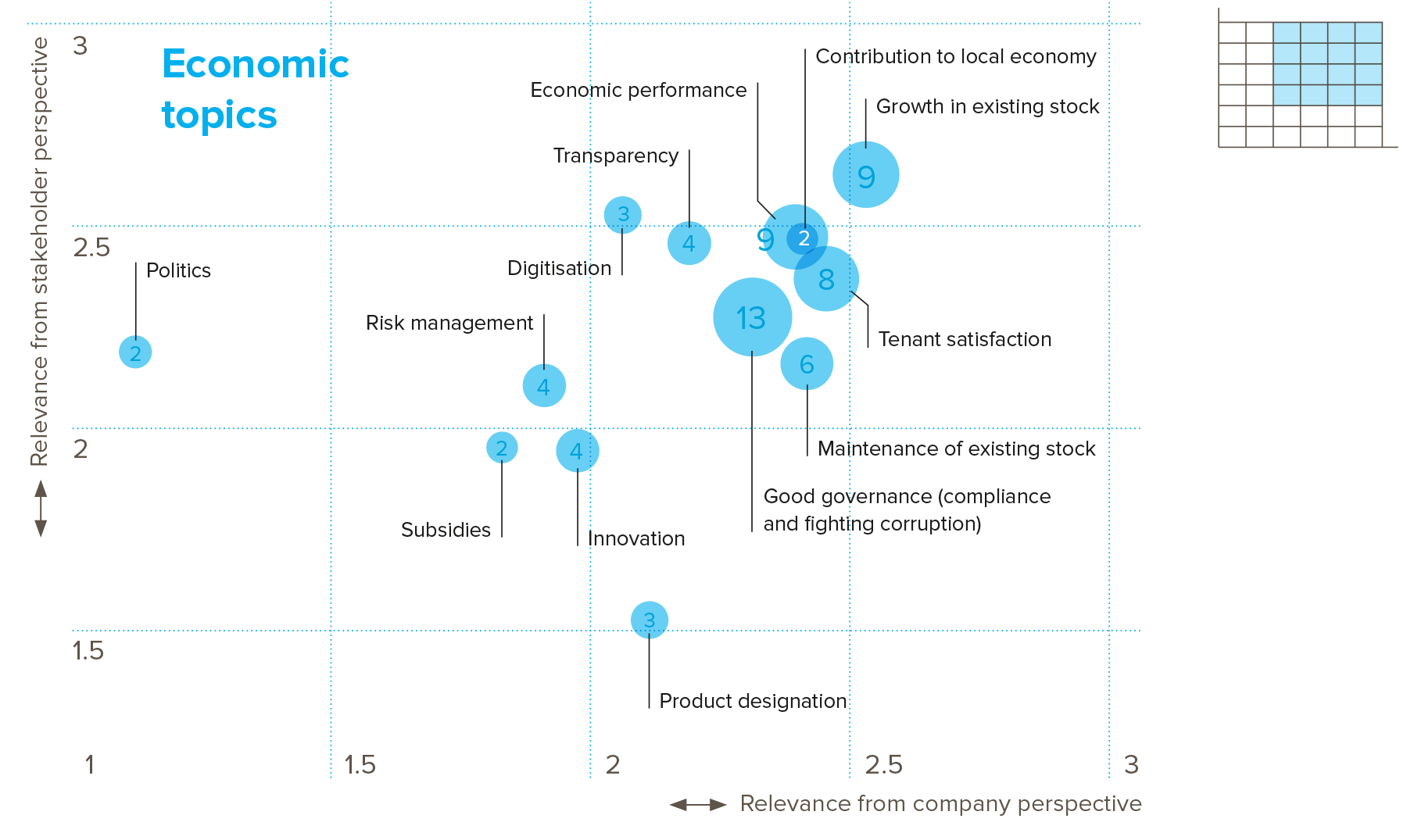

Fig. 11: Assessment of the relevance of all three subject areas in relation to each other

Contact

Do you have questions regarding this topic? Please contact:

-

Dr. Mathias Hain

Dr. Mathias Hain-

email hidden; JavaScript is required

-

email hidden; JavaScript is required

-

Lutz Rittig

Lutz Rittig-

email hidden; JavaScript is required

-

email hidden; JavaScript is required

-

Sebastian Wolf

Sebastian Wolf-

email hidden; JavaScript is required

-

email hidden; JavaScript is required

1 Statement of Intent to Work Together Towards Comprehensive Corporate Reporting: PDF

2 https://www.globalreporting.org/public-policy-partnerships/sustainable-development/sdg-initiatives/

4 Sec. 264d of the German Commercial Code (HGB): A company is deemed to be oriented toward the capital market if it makes use of an organized market within the meaning of Sec. 2 (11) of the Securities Trading Act through securities issued by the company within the meaning of Sec. 2 (1) of the Securities Trading Act or has requested that such securities be admitted to trading on an organized market.

5 Adopted by the German Bundestag on March 9, 2017 (Sec. 289b et seq. HGB) on the basis of EU Directive 2014/95/EU

6 https://www.bundesregierung.de/breg-de/themen/klimaschutz/klimaschutzgesetz-2021-1913672

7 The “Wohnen 2050” initiative was established in early 2020. It currently has 80 partners representing some 1.7 million housing units.

9 The top 50 German housing companies comprise 17 private and 33 municipal companies. They were selected according to the number of residential units directly owned.

10 See Official Journal of the European Union: Guidelines on non-financial reporting (2017/C 215/01)

11 Vivawest, which is majority owned by the RAG-Stiftung, is treated as a private enterprise in this analysis.

12 Thirty-four percent of the top 50 companies are private, and 66% are municipal entities.

13 This is distinct from the term ESG (environment, social, governance), which is used mainly in a capital market-oriented context.

14 For purposes of comparability, all materiality matrices were standardised using the same scale, so that the overall matrix uses scales from 0 to 3.

15 See Prognos Endbericht Studie Wohnungsbautag (PDF)

17 See https://www.haufe.de/immobilie...

18 The EU taxonomy includes six categories: 1. Climate change mitigation; 2. Climate change adaptation; 3. Sustainable use and protection of water and marine resources; 4. Transition to a circular economy, waste prevention, and recycling; 5. Pollution prevention and control; 6. Protection and restoration of biodiversity and ecosystems

19 Until 2023, the law will initially apply to companies with more than 3,000 employees. Companies with more than 1,000 employees will be phased in starting in 2024