Operational Restructuring

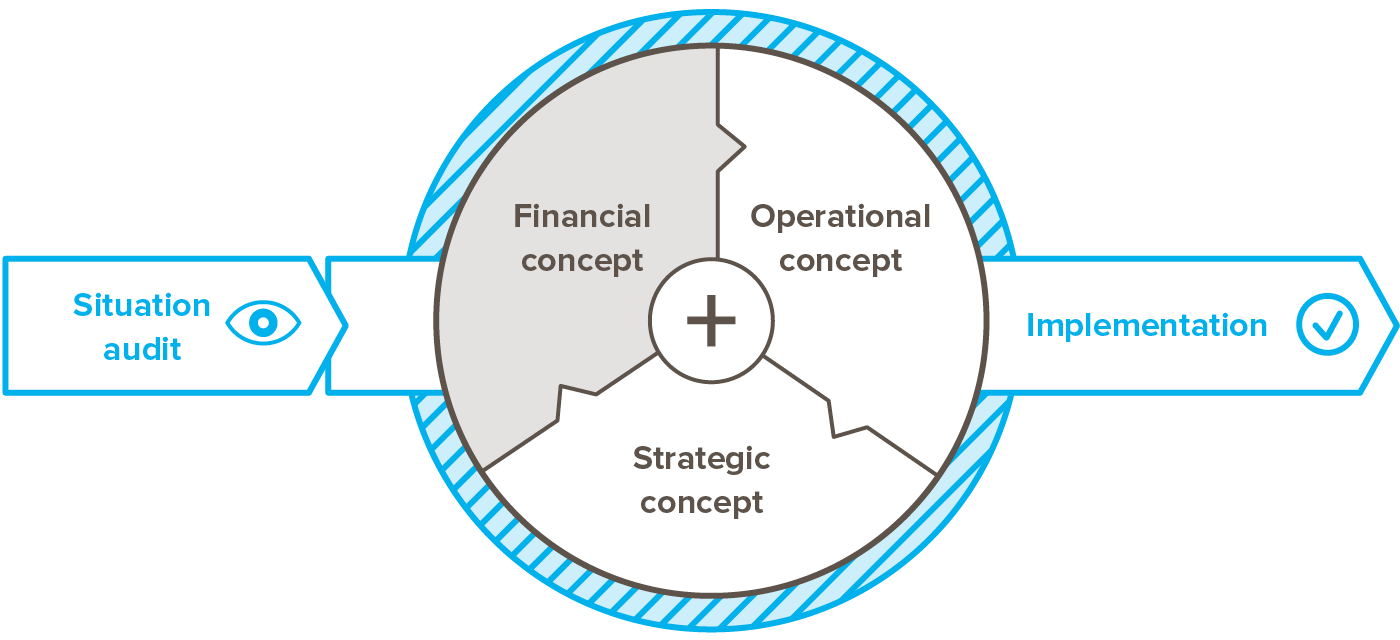

RITTERWALD advises companies on strategic, operational and financial restructuring.

As our clients, we can help you access rescue capital, reorganize your bank borrowings, implement internal and external restructuring measures and change your equity base.

In our work, the importance of finding the best solutions for whatever financing situations our clients face is paramount. This can range from traditional refinancing with existing or new financing partners to debt reduction and debt-to-equity swaps. We also keep an eye on shareholders’ equity by helping our clients attract new investors to support their financial restructuring. In the process of combining the various restructuring elements, we draw on our experience with subsidies and leasing schemes and also integrate these possibilities into our clients’ strategies going forward.

Restructuring project phases