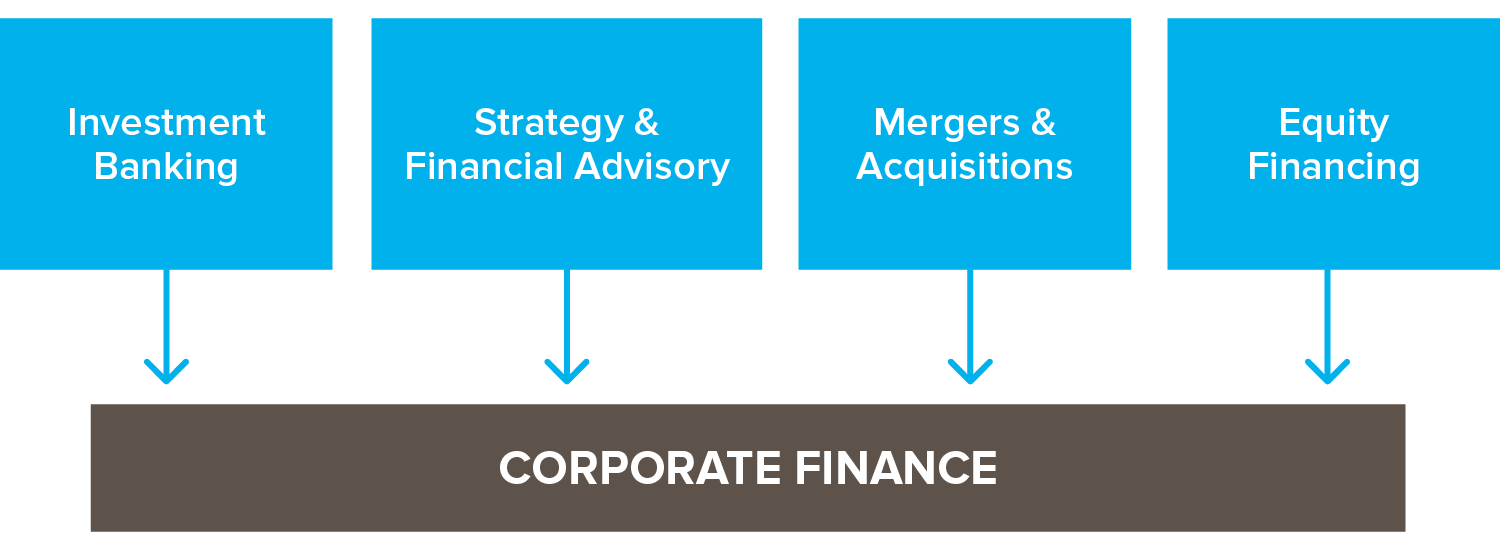

At RITTERWALD we support and help you document M&A, strategy and restructuring projects with financial analyses and liquidity and business plans individually tailored to our clients’ needs. Our focus lies on operational business consulting and on performance analysis of property holding and property management companies as well as asset managers and the issuers of investment company and real asset funds (real estate, aircraft, ships, etc.).

We provide integrated support, working to optimize your company’s asset structure and asset accumulation along the entire value chain. Financial analyses are the key management tools applied here, from key performance indicators to cash flow statements, investment calculations and balance sheet analyses.